↘️ The Collapse of LUNA, explained

How $60 billion was wiped out of nowhere

Today's Highlights

- The downside of algorithmic stablecoins

- Today's Infographic

- In Other News - a few interesting developments we're tracking.

The downside of algorithmic stablecoins

In the past few months, many cryptocurrency projects have been rising to great lengths at tremendous speeds and then crashing and burning at those same speeds. But no other cryptocurrency crashed as much in recent months as LUNA.

The Luna coin was part of the Terra blockchain. There were two prominent coins on the blockchain: Luna and TerraUSD(UST). UST is an algorithmic stablecoin, which is different from fiat-backed stablecoins meaning that it is backed by a cryptocurrency rather than a real asset like the US dollar. Stablecoins are always meant to have a fixed value such as 1 USD.

Luna prices rose from less than a dollar in 2021 to almost $116 by April 2022. It was frequently praised in the crypto community for regularly making people rich from buying the coin. There was also a massive incentive for holding the coin where you can get a 20% annual yield by staking your holding of UST on the Anchor lending platform. More than 70% of total UST was staked on the platform.

UST was always a risky coin since it was backed by a volatile cryptocurrency rather than real assets. The cracks started to show in early May 2022, when over $2 billion worth of UST was unstaked and hundreds of millions of dollars was liquidated. This caused the price of UST to drop to around $0.90. This caused many traders to exchange their UST tokens for $1 Luna tokens, which led to a massive increase in the supply and circulation of LUNA. This made the coin virtually worthless and the project was abandoned.

Over $60 billion of Luna was wiped out, and this impacted the wider crypto market as well. When all was said and done, an estimated $300 billion was wiped out from the market. The founder, Do Kwon, launched a Luna 2.0, but that didn’t pan out as hoped as well. In mid-September, South Korean officials sent out a warrant for his arrest for violating local market laws.

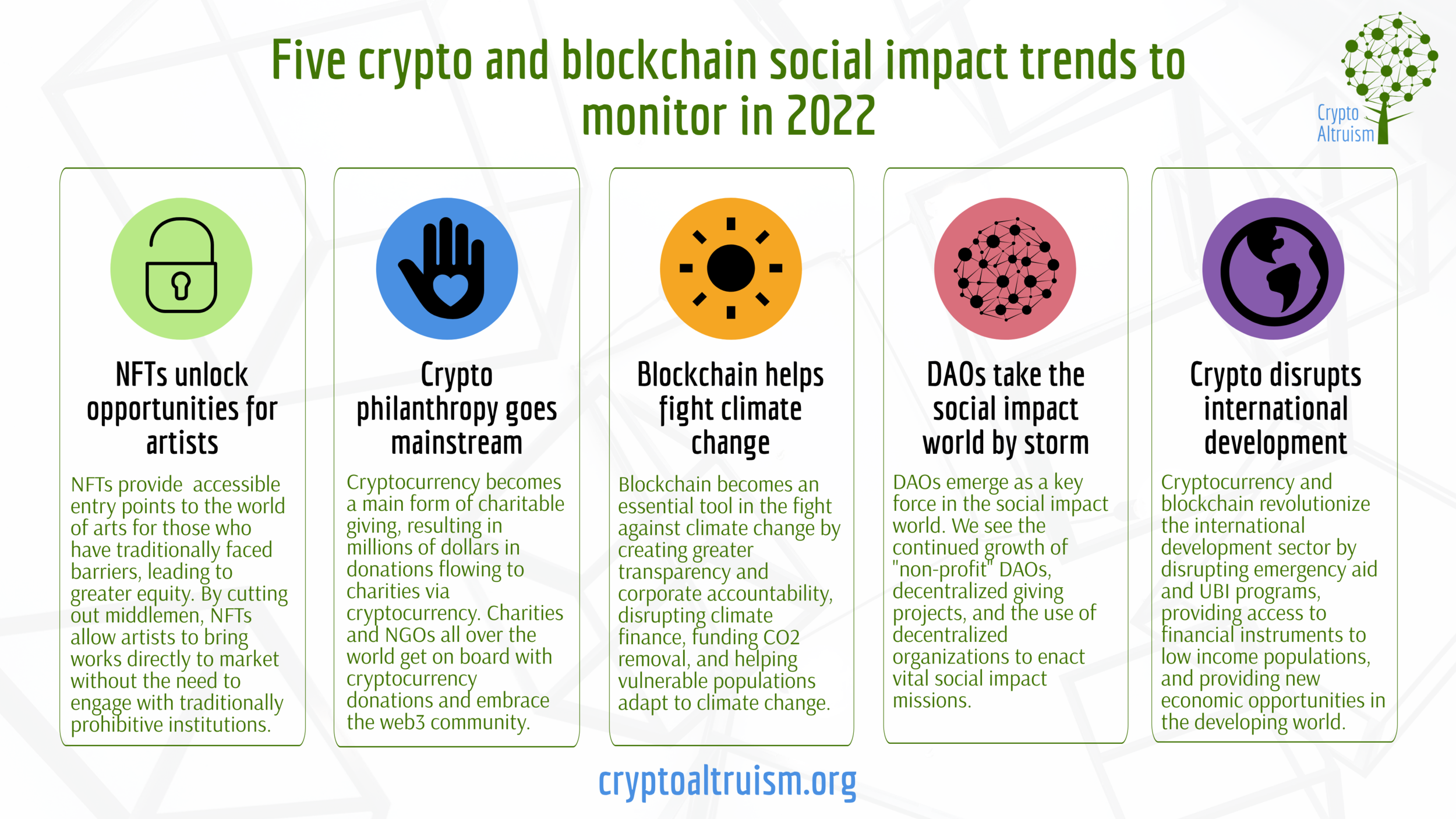

🧐 Today's Infographic

In Other News