💰 Stable digital currency

A review of stablecoins and how they work.

Today's Highlights

- Stablecoins

- Blockchain jobs - a listing of fresh jobs related to web3/blockchain/crypto.

- In Other News - a few interesting developments we're tracking.

Stablecoins

As cryptocurrencies are taking the world by storm, there exists a form of digital money known as Stablecoins. While stablecoins are technically still crypto, they differ from other popular currencies such as Bitcoin (BTC), due to them being not as high volatile as these. Stablecoin values are, instead, pegged to that of another currency (ex: the US dollar), commodity, or financial instrument. There are 3 different types of stablecoins: Fiat-collateralized, Crypto-collateralized, and Algorithmic.

Fiat-collateralized stablecoins are coins that maintain a reserve of currency, such as the US dollar, gold & silver, or even crude oil. However, most have reserves of USD. Prominent examples of Fiat-collateralized coins include Tether (USDT) and TrueUSD (TUSD).

Crypto-collateralized stablecoins are coins that are pegged to other cryptocurrencies. Since a lot of cryptocurrencies are very volatile, crypto-backed stablecoins are over-collateralized, which means that the value of the cryptocurrency will likely be much, much higher than the price of that crypto’s stablecoin since the risk needs to be minimized. An example of a crypto-collateralized stablecoin is MakerDAO’s Dai (DAI) which is pegged to the USD but backed by Ethereum (ETH).

Algorithmic stablecoins are different from the previous two types because they are likely to not even have collateral at all. Instead, they function much like the Federal Reserve as they use a consensual mechanism (in this case, an algorithm) to increase or decrease the supply of tokens. But it is hard for algorithmic stablecoins to have as much credibility as the Federal Reserve, and it has negatively impacted coins such as Terra (UST). Terra fell more than 60% last month because Luna, which lost more than 80% of its value overnight, was pegged to Terra.

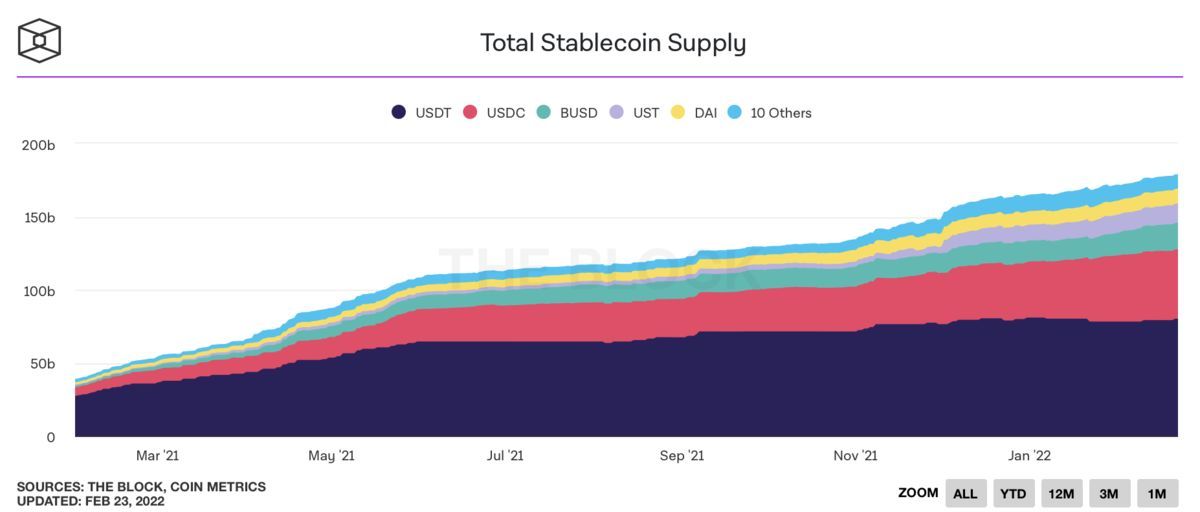

Since the beginning of 2020, the total market value of stablecoins went from almost $0 to exceeding $170 billion. While this is nowhere near the money supply of many countries, this rapid increase in the use of stablecoins demonstrates the interest in fully digital money. The future of stablecoins seems bright.

💡 Blockchain Jobs

|

Tea, Inc.

|

Crastonic Ltd.

|

|

Crastonic Ltd.

|

Futureswap

|

In Other News