🇮🇩 Breaking Barriers in Banking

Flip, an Indonesian fintech, streamlines money transfers with over 7 million users and growing.

Today's Highlights

- Flip - revolutionizing money transfers in Indonesia

- Learn - a couple of courses to further your knowledge in crypto

- In Other News - a few interesting developments we're tracking

Flip - revolutionizing money transfers in Indonesia

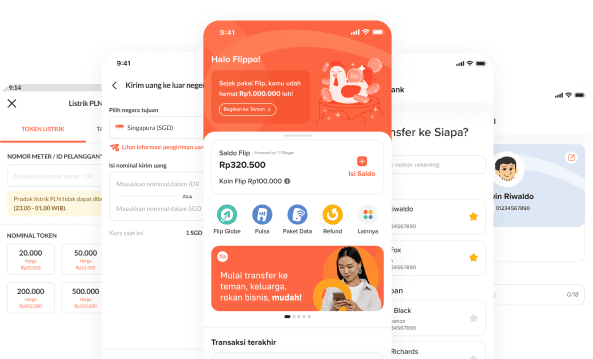

In Indonesia, the process of transferring money can be tedious for bank account holders. They often encounter issues such as funds getting stuck during transfers, lengthy clerical procedures, and poor user experiences with outdated interfaces and complicated workflows. However, Flip aims to address these challenges by assisting individuals and businesses in streamlining their money transfers at a minimal cost. Flip aspires to become the world's most customer-centric financial technology company, empowering users to conduct transparent financial transactions effortlessly. The startup acquired a license from Bank Indonesia (BI) in 2016, enabling it to offer a range of financial services, including interbank transfers to over 100 domestic banks, international remittances, e-wallet top-ups, salary transfers, and business solution products.

Flip serves a user base exceeding seven million individuals, facilitating a wide range of financial transactions both within Indonesia and across international borders. Users rely on Flip for diverse purposes, including sending and receiving money to and from various regions within Indonesia, as well as conducting overseas money transfers. Moreover, Flip has garnered significant adoption among more than 340 Indonesian companies and SMEs operating in sectors such as travel, hospitality, e-commerce, transportation, education, outsourcing, crowdfunding, and business management. These businesses leverage Flip's services for essential operations like employee payroll, customer refunds, invoice and supplier payments, as well as international transfers. The convenience of Flip extends to its mobile application, available for both iOS and Android platforms, allowing users to complete the entire payment process directly on their phones. This mobile-centric approach offers a simple and user-friendly experience.

The number of Flip's users has grown exponentially, experiencing a tenfold increase compared to pre-pandemic levels. This surge can be attributed to the rising adoption of technology and the imposition of mobility restrictions in Indonesia. With the implementation of protocols to curb mobility during the pandemic, numerous bank offices were forced to close, prompting individuals to turn to technology-driven solutions for their financial transactions. This shift in consumer behavior, from traditional bank branch visits to the utilization of digital products, has significantly contributed to Flip's growth.

Flip’s co-founders are Rafi Putra Arriyan, Luqman Sungkar and Ginanjar Ibnu Solikhin. They have raised a total of $120M in funding.

📚 Learn

|

AICPA

|

|

Co-Pierre Georg

|

In Other News