🏦 Consumer-Friendly Banking

Kroo - removing the difficulties in personal transactions

Today's Highlights

- Kroo - online banking without the clutter

- Today's Infographic

- In Other News - a few interesting developments we're tracking.

Kroo - online banking without the clutter

London-based Kroo was established in 2016 with the aim of removing awkwardness from financial interactions with friends and family. Previously known as B-Social, Kroo announced it had become a fully licensed bank in June 2022. Kroo offers a free, digital-only Financial Services Compensation Scheme -protected current account and debit card, to help manage personal and social spending. Its current account has a monthly interest rate and a single rate overdraft subject to eligibility. The app offers detailed spending insights and the card won’t charge foreign exchange fees or cash withdrawal fees when used overseas.

It is free to open a Kroo current account and there are no ongoing account management fees. Kroo won’t charge for using ATMs overseas. Different groups can be created with friends (or family) to manage shared spending such as bills or splitting the cost of a holiday. Kroo offers fingerprint and Face ID security features, as well as the option of freezing and unfreezing the card if it's lost. Plus, every time a friend is referred, Kroo promises to plant 20 trees to say thank you.

PayrNet Limited, which issues the Kroo card, is authorized by the Financial Conduct Authority (FCA). Under the Electronic Money Regulations 2011, PayrNet must hold the client’s money in a segregated account which is protected by safeguarding requirements. This means that if PayrNet Limited becomes insolvent, all funds will be protected against claims made by creditors.

Nazim Valimahomed and Tim Brown are the co-founders of Kroo. They have raised a total $71.5M in funding.

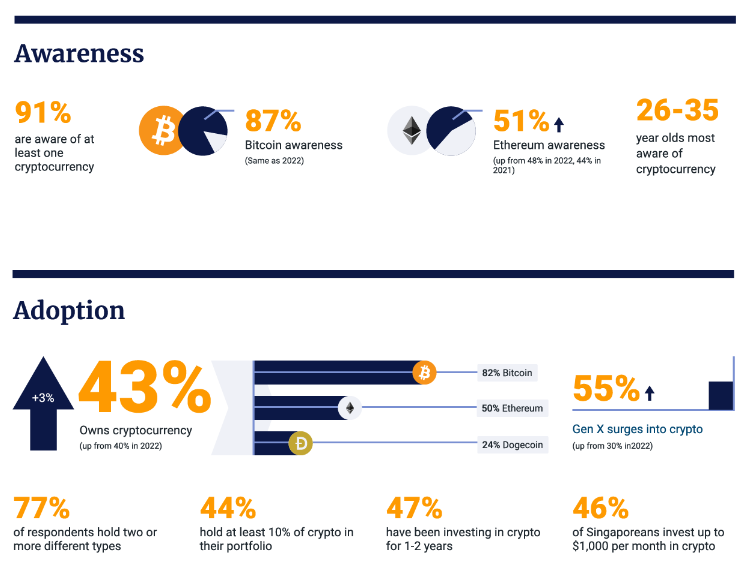

🧐 Today's Infographic

In Other News