♽ Blockchain in Money Transfers

Explaining the importance of blockchain for speeding up the remittance process

Today's Highlights

- Blockchain Remittance

- Today's Infographic

- In Other News - a few interesting developments we're tracking.

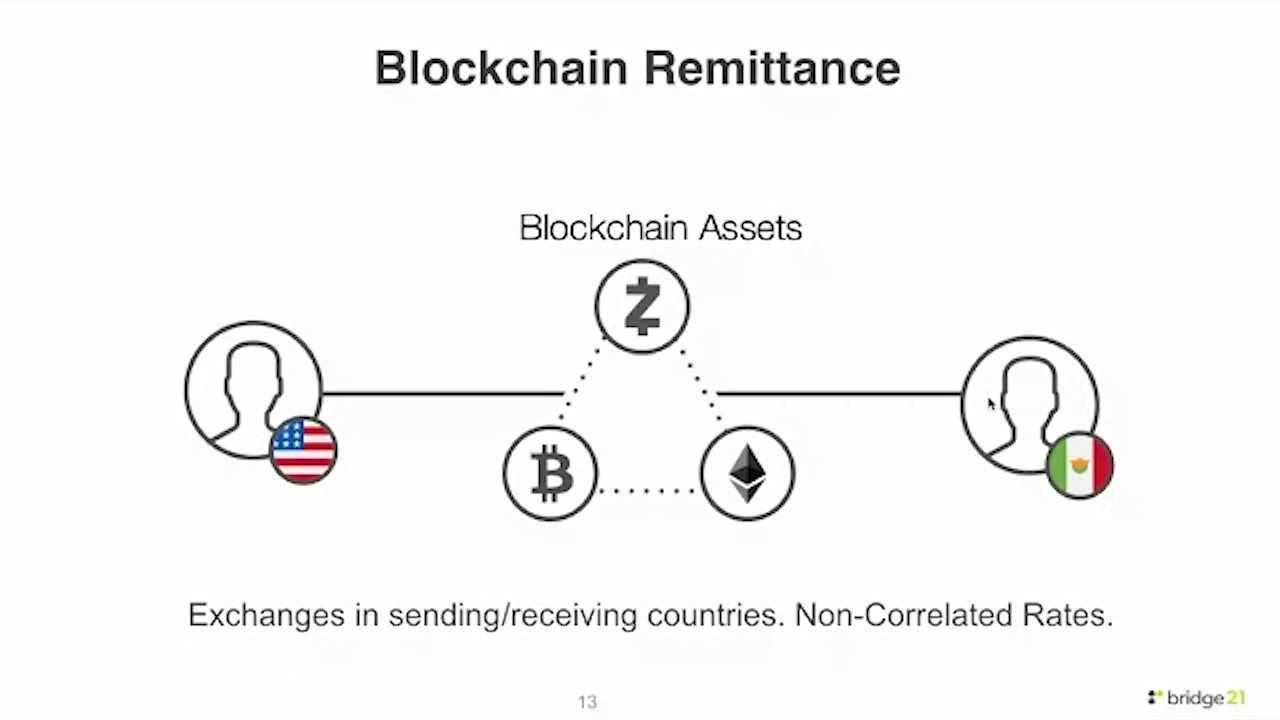

Blockchain Remittance

In this world where online banking is very prominent, quick money transfers between friends and families have been a very important innovation. The days of paying someone back with cash are gone, where now, they just Zelle or Venmo the other person and they have the money in their bank account (or Venmo account) without them having to go to a bank and deposit the cash there.

But money transfers in the remittance economy are still very slow. Remittance refers to cross-border money transactions between migrant workers and their home countries. But remittance transactions are very slow and could take up to 5 days for a transfer. Blockchain can speed up the remittance process, however.

Blockchain eliminates the need for every mediator in remittance except for the bank. This allows for lower costs, in addition to reducing the time it takes for a transfer to be completed. Blockchain remittance can be applied in most traditional banking areas such as a mobile bank on a smartphone or even an ATM.

Blockchain remittance is also very secure. It utilizes the core principles of cryptography for verification and security. All transactions done will be recorded on a public ledger, although maximum privacy for all entities involved will be guaranteed. Various Algorithms are also employed to ensure that data is not tampered with.

Some downside of using blockchain for remittance is that the process requires the use of cryptocurrency which means the user will have to use their bank account to acquire tokens, which is quite inconvenient. The process also needs a stable internet connection at all times, even though ATMs can be used. This could be a problem in many places in the world where the internet is not reliable.

The bottom line is that blockchain remittance will speed up the cross-border money transfer process by a lot, with a few caveats. It may not be the ultimate solution, but it is a step in the right direction.

🧐 Today's Infographic

In Other News