📄 Blockchain in Insurance

How blockchain can help insurance companies offer cheaper insurance without sacrificing their bottom line

Today's Highlights

- A more competitive insurance market

- Today's Infographic

- In Other News - a few interesting developments we're tracking.

A more competitive insurance market

There has never been a time where insurance services are needed to this level. As the number of insurance policy holders grows, the strain on insurance companies will only increase. They need services that can help them do tasks automatically and that can help them give quotes more efficiently.

Blockchain has the potential to do both things with ease. It can help save time, cut costs, improve transparency, combat fraud, among other things.

Data is shared between various parties in real time which can help leverage insurance companies to build a better product and a better company. Consumers demand the best value and blockchain can help optimize the costs while making sure the company still gets enough profit.

Ethereum’s smart contracts can automate tamper-proof audit trails, and this allows customers to get a quote much quicker and with less manpower. The low cost of smart contracts means that quotes could be rendered at much more competitive prices, which benefits the consumers and the companies since they can still rake in profits.

Insurance using the blockchain will also require insurance for itself. Insurance companies can be insured for financial loss, specie and crime, professional liability, and more. ConsenSys Diligence, for example, is a blockchain company that works with insurers to help assess risk and mitigation.

Blockchain has the potential to change the insurance industry forever, and it can finally help put a stop to predatory practices that have long been plaguing the insurance industry by offering competitive and fair quotes.

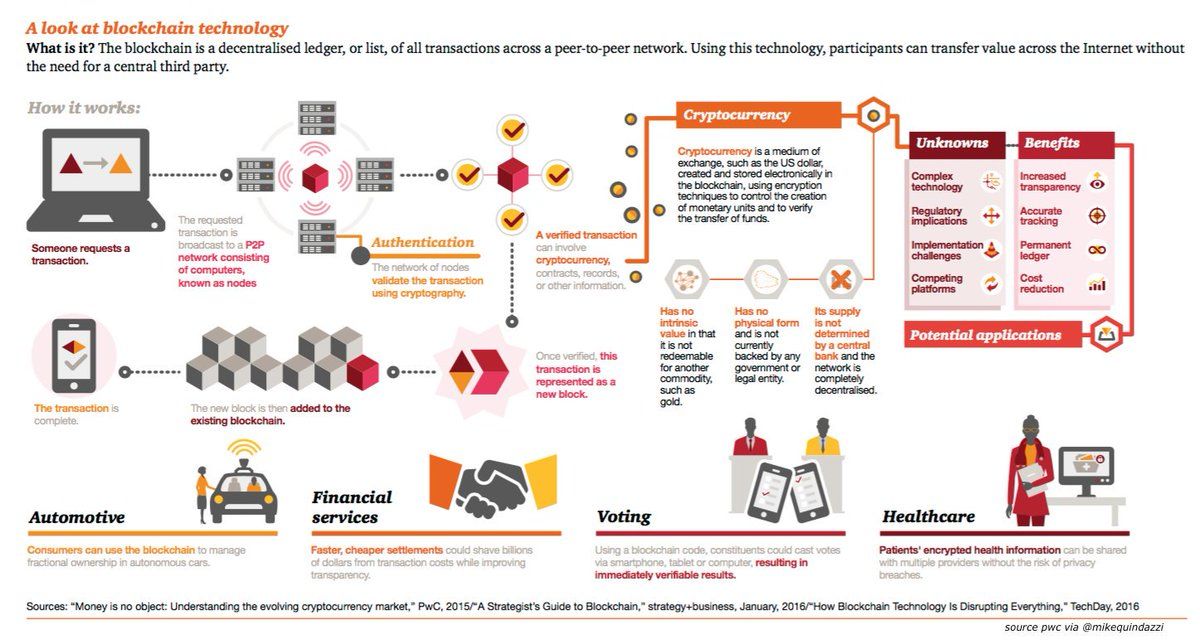

🧐 Today's Infographic

In Other News