📉 Navigating the New Frontier of Portfolio Management

AI is revolutionizing portfolio management through enhanced data analysis, optimized trading algorithms, and advanced fraud detection.

Today's Highlights

- How AI is disrupting Portfolio Management

- This Week On BuzzBelow - a recap on this week's topics

- In Other News - a few interesting developments we're tracking

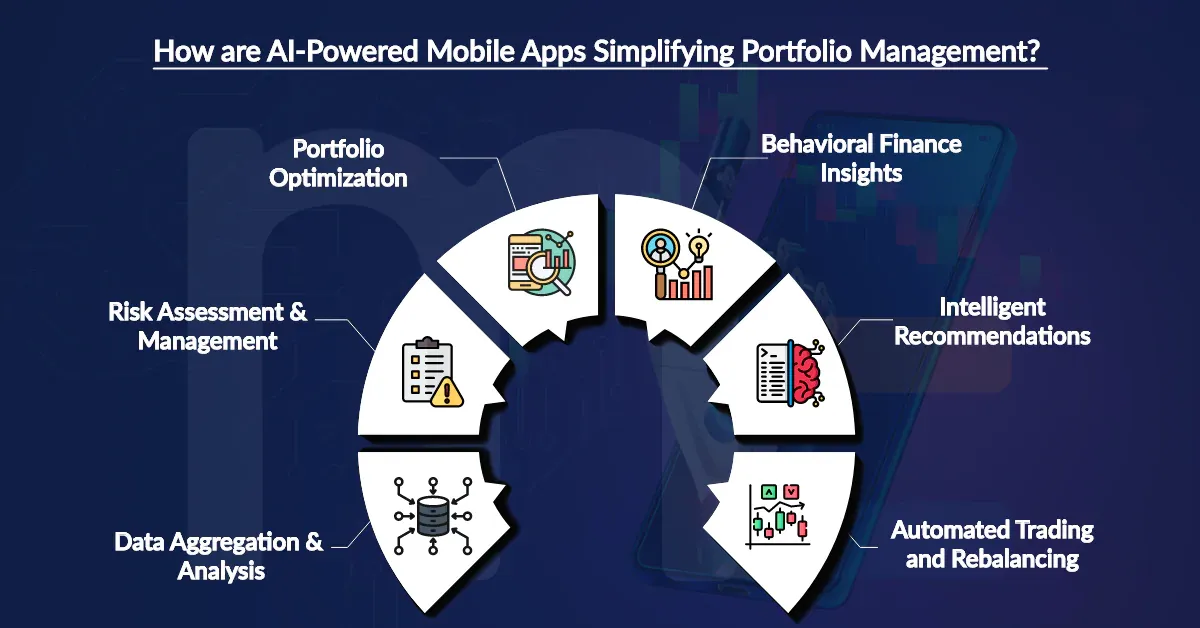

Artificial Intelligence (AI) is changing finance as we know it at a rapid pace, especially portfolio management. AI algorithms can analyze large volumes of data to identify investment opportunities and risks that would be impossible for a human to assess in a reasonable timeframe. Here are some key ways AI is being utilized in portfolio management:

Reinforcement Learning in Algorithmic Trading

Reinforcement learning (RL) is used in algorithmic trading, where trading agents interact with a dynamic market environment to learn optimal strategies through trial and error. Real-time trading strategy adjustments are made by these agents in order to maximize profits or achieve other specified investment goals. An example of a project in this area is the Stock Trading Bot using Deep Q-Learning, which demonstrates a bot capable of trading a set of stocks based on learned strategies.

Quantitative Finance Models and AI

Modern Portfolio Theory for asset allocation and the Black-Scholes model for option pricing are two examples of quantitative finance models that can be integrated with advanced AI. AI improves these models by enabling real-time adjustments based on fresh data and adaptive learning, which results in more effective risk management and portfolio optimization. The Deep Reinforcement Learning Framework for the Financial Portfolio Management Problem shows an implementation of this, which enhances the efficiency and success rates of human managers, decreases organizational risk, and increases ROI.

Anomaly Detection for Fraud and Risk Management

Algorithms for anomaly detection are used by AI systems to keep an eye on transaction trends and identify anomalous activity that could be fraud. The AI can detect anomalies with great accuracy by learning the typical transaction patterns; these are then looked into further. Feedzai offers banks and other sectors a platform for detecting anomalies driven by artificial intelligence. Their machine learning approach learns from an ongoing stream of data, including bank transactions, to detect irregularities that point to fraud and establish a baseline of normalcy. The model can be further trained by the system to increase its accuracy in detecting fraud.

These technologies have been adopted at a massive rate. Approximately 70% of financial services firms use machine learning for functions like predicting cash flow events, fine-tuning credit scores, and detecting fraud. The global AI fintech market is expected to reach $22.6B by 2025, with a CAGR of 23.37% from 2020 to 2025. The integration of AI in finance is not just an emerging trend; it is a paradigm shift that is reshaping portfolio management and the broader financial services industry.

This Week on BuzzBelow

In Other News