💰Smart Money Matters

AI is transforming personal finance with tailored insights and recommendations for optimized money management.

Today's Highlights

- How AI is helping in personal finance

- Learn - a couple of courses to further your knowledge in AI

- AI Jobs - a listing of fresh jobs related to AI

- In Other News - a few interesting developments we're tracking

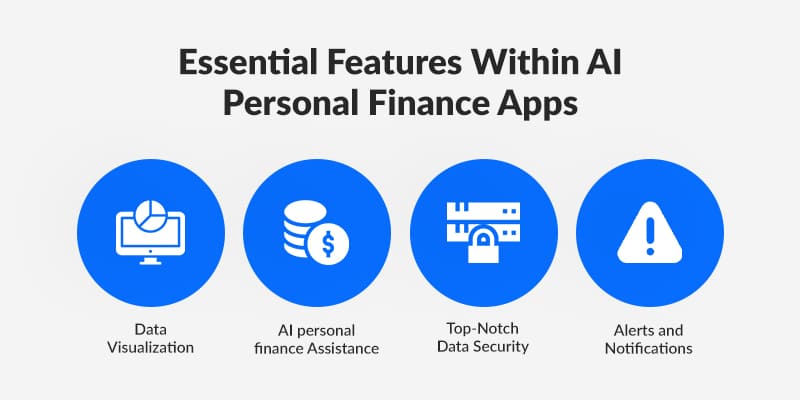

In the rapidly evolving landscape of personal finance, artificial intelligence (AI) is playing an increasingly pivotal role, revolutionizing the way individuals manage their money and plan for the future. AI-based personal finance platforms leverage advanced algorithms to analyze vast amounts of financial data, providing users with personalized insights, recommendations, and educational resources. These platforms offer a comprehensive suite of tools and services, ranging from budgeting and investment management to debt optimization and retirement planning. By harnessing the power of AI, these platforms empower individuals to take control of their finances, make informed decisions, and achieve their long-term financial goals.

- A personal finance app leveraging AI technology

- Analyzes users' financial accounts to provide insights

- Identifies spending patterns, subscriptions, and recurring expenses

- Offers tools for budgeting, saving, and tracking financial goals

- Empowers users to make informed financial decisions based on personalized insights

- Streamlines financial management by providing a comprehensive overview of expenses and income

- Helps users optimize their finances and achieve their financial objectives more efficiently

- A robo-advisor platform integrating AI technology for automated investment management

- Utilizes algorithms to optimize investment strategies for users

- Automatically rebalances portfolios to maintain desired asset allocations

- Minimizes taxes through tax-loss harvesting techniques

- Maximizes returns by considering users' financial profiles, goals, and preferences

- Offers diversified investment portfolios tailored to individual risk tolerance and time horizon

- Provides a hands-off approach to investing, making it accessible and convenient for users of all experience levels

- Continuously adapts investment strategies based on market conditions and user preferences to achieve optimal outcomes

- A micro-investing app that automates investment through spare change

- Rounds up users' everyday purchases to the nearest dollar

- Invests the spare change in diversified portfolios

- Utilizes algorithms for automated investment decisions

- Provides personalized recommendations based on users' spending behavior

- Offers a hands-off approach to investing, making it easy for users to start investing with small amounts

- Helps users grow their savings and investments gradually over time

- While not solely AI-driven, Acorns leverages algorithms to enhance investment decisions and tailor recommendations to individual users

AI in personal finance is changing the way individuals manage their money. From budgeting and saving to investment management and retirement planning, AI is streamlining financial decision-making and helping users achieve their financial goals more efficiently. With AI-driven tools, individuals can take control of their finances, optimize their wealth management strategies, and build a more secure financial future.

📚 Learn

|

IBM

|

|

Vanderbilt University

|

🧑💻 Jobs

|

Epic Games

|

|

Latch

|

🔔 In Other News